Brand health is an essential measure of a brand’s effectiveness and market presence; it’s about understanding a brand’s overall performance in the eyes of consumers and in the marketplace. Brand health tracking involves assessing various brand health metrics to establish a complete picture of your brand’s current position and where it could improve.

In this article, we delve into the key components of brand health:

What is brand health tracking?

Brand health tracking combines various brand health metrics to provide a comprehensive view of your overall brand performance and the effectiveness of your marketing campaigns. This helps you to optimize your strategy and drive future growth.

The happier your customers, the stronger your brand health. If you’re delivering on your promises, you’ll perform well across brand health metrics.

Core brand health metrics include Advertising Awareness, Net Promoter Score (or Recommendation), Word of Mouth, Purchase Intent, Consideration, Customer Satisfaction, Quality, Value and more. These metrics are designed to evaluate every stage of the consumer purchase funnel, and your media and communications profile.

Measuring these brand health metrics usually involves brand research through online surveys or questionnaires, social listening tools and qualitative research with focus groups. An effective brand health survey measures sentiments and responses from your current audience, target customers and the general population, providing insights into what they think, feel, and say about your brand.

In this article, we will explore each of these aspects in more detail, offering insights into how you can effectively track and enhance your brand's health in today's competitive market.

Why is tracking brand health important?

To be successful, brands need to set clear measures of success as part of their brand strategy.

Brand health tracking helps you understand what’s working, and what’s not. It ensures you invest time and marketing budget wisely, focusing on initiatives that truly impact your brand health.

Brand health tracking tells you what people think of your brand, how they buy and use your products, who remembers your advertising (brand recall) and more.

Tracking brand health metrics can help you:

1. Measure marketing effectiveness and campaigns

Tracking brand health allows you to assess the impact of your marketing initiatives. By understanding how they influence brand health metrics like Advertising Awareness or Purchase Intent, you can gauge their success and return on investment.

2. Measure PR success

Public relations play a significant role in shaping brand perception. Brand health tracking helps you understand how PR efforts are affecting your brand's image and reputation in the market.

3. Understand which messaging is working

Through brand health tracking, you can identify which messages resonate with your audience. This understanding is key to refining your communication strategy and ensuring your messaging aligns with customer expectations and preferences.

4. Benchmark against competitor brands in your sector

By tracking your brand health metrics, you can compare your brand’s performance against competitors. This benchmarking is invaluable for understanding your market position and identifying areas where you can differentiate your brand.

5. Identify loyal brand advocates

Brand health tracking helps you identify your brand's promoters – customers who are likely to recommend your brand to others. Understanding who these advocates are allows you to foster these relationships and leverage them through targeted marketing.

6. Recognize a brand reputation crisis

A brand reputation crisis isn’t something anyone wishes for, but if you find yourself in the hotseat and suffering from negative PR, brand health tracking can help identify the areas where you need to bolster your brand’s perception with your previous, current or target customers.

7. Spot negative trends in your sector and combat them

Brand health tracking gives you insights into broader market trends and challenges. This knowledge enables you to proactively adjust your strategies to stay ahead in your sector.

An effective brand health strategy involves continuously measuring and analyzing these aspects to maintain a strong and resilient brand. In the following sections, we will delve into the specific brand health metrics and how they can be measured effectively.

What are the primary brand health metrics?

To measure brand health, you can track the scores for your brand across several key brand health metrics. YouGov’s brand health tracker tool, BrandIndex, does this by evaluating your brand across 16 brand health metrics, offering a comprehensive view of your brand.

These 16 brand health metrics are categorized into three main areas:

1. Media & communication

This category focuses on the public discourse about your brand. It includes metrics like:

Advertising Awareness:

Gauging the recognition of your brand's advertising.

Aided Brand Awareness:

Assessing brand recognition when consumers are prompted.

Attention:

Measuring the level of focus your brand attracts in the media.

Buzz:

Tracking the volume and sentiment of conversations about your brand.

Word of Mouth Exposure:

Quantifying how frequently people discuss your brand in their conversations.

These metrics collectively paint a picture of how your brand is being perceived and talked about, reflecting its visibility and reputation in the public eye.

2. Brand perception

This category delves into how consumers perceive and feel about your brand. It includes:

General Impression:

Reflecting the overall sentiment towards your brand.

Customer Satisfaction:

Gauging how satisfied customers are with your products or services.

Quality:

Assessing consumer perceptions of your brand's quality.

Value:

Evaluating how consumers perceive the value for money of your offerings.

Corporate Reputation:

Measuring public perception of your brand as an employer and corporate entity.

Recommendation:

Tracking the likelihood of customers recommending your brand.

Index (Overall Brand Health):

Providing a comprehensive summary of your brand's overall health.

3. Purchase funnel

This area evaluates how consumers interact with your brand throughout their purchasing journey. It includes:

Purchase Intent:

Indicating consumers' likelihood of purchasing your brand.

Consideration:

Measuring the extent to which consumers consider your brand as a potential choice.

Current Customer:

Identifying those who have recently purchased from your brand.

Former Customer:

Assessing those who have previously engaged with your brand but currently do not.

These metrics offer insights into your brand's position from initial consideration through to purchase and post-purchase phases.

This level of analysis enables brands to understand not only their market position but also the effectiveness of their communication strategies and the strength of their customer relationships.

In the following sections, we’ll explore in detail the significance of each metric and how it can be measured.

How can you measure them?

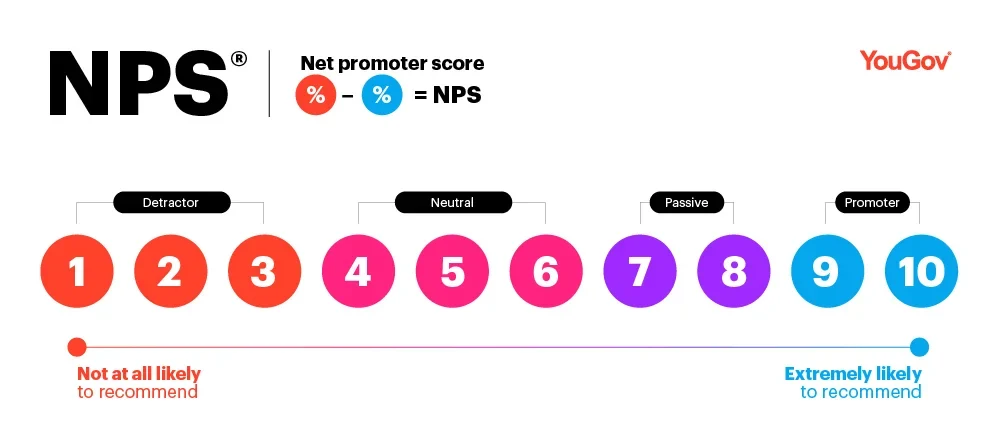

Recommendation or NPS: Net Promoter Score

The NPS ® – or Net Promoter Score – question is perhaps the best known, and most simple, measurement of customer experience and loyalty:

- How likely is it that you would recommend [name of organisation/product/service] to a friend or colleague?

It indicates to brands how their customers are feeling about them and likelihood of recommendation, grouping customers into three categories:

Detractors:

Reported likelihood to recommend a brand is 0-6

Passives:

Reported likelihood to recommend a brand is 7-8

Promoters:

Reported likelihood to recommend a brand is 9-10

Overall scores are calculated by subtracting the percentage of detractors from the percentage of promoters.

YouGov helps brands to look beyond NPS to track what ‘recommendation’ really means, how customer experiences influence it, and which brand health metrics impact it.

Our daily tracking helps clients to understand how they can continuously improve their NPS score, by re-contacting relevant customer groups to get the context about your detractors, passives and promoters.

The Recommendation question on YouGov’s brand health tracker is:

- Which of the following brands would you RECOMMEND/tell a friend to AVOID?

Connecting to our audience data, we can help you find the context on who makes up your audience of recommenders, as well as enable you to re-contact the same respondents to better understand their experience.

Advertising Awareness (brand recall)

Awareness or brand recall looks at the brands consumers have been exposed to or are familiar with. In the case of advertising awareness, it revolves around brands they have recently seen advertising for. You might ask an audience:

- Which of the following brands have you seen an advertisement for in the past two weeks?

Aided Brand Awareness

Aided brand awareness asks consumers which brands they have heard of, providing a list to choose from and then tracking those they select:

- Which of the following brands have you ever heard of?

Awareness might also be tracked without aid, by simply asking respondents to name brands they can think of in a certain category, like non-alcoholic beverages or car manufacturers.

Buzz (positive - negative sentiment around your brand)

Sentiment analysis reviews brand reputation i.e., what consumers are expressing about a particular brand, and whether it is positive or negative. Asking customers to do this themselves- tracking positive and negative news or stories they’ve heard – allows you to track PR coverage, campaign success, crises and more.

Over the past two weeks, which of the following brands have you heard something POSITIVE / NEGATIVE about (whether in the news, through advertising, or talking to friends and family)?

This approach not only measures sentiment, but also provides a pulse on your brand’s public perception.

Attention (positive + negative sentiment around your brand)

Attention measures how much a brand’s reputation is in the current spotlight – has recent brand news had cut-through with respondents?

The percentage of respondents who have reported hearing anything, either POSITIVE / NEGATIVE about a brand over the past two weeks (positive + negative Buzz)

Word of Mouth Exposure

Word of Mouth Exposure tracks which brands respondents report talking about with friends and family. It is ideal for tracking the brands people are reportedly discussing in conversation, to understand current trends, relevancy and share of voice.

In the past two weeks, which brands have you talked about with family and friends?

General Impression

General instincts about your brand say a lot, forming an overall positive or negative perception among consumers and providing a clear an understanding of public reputation. This is helpful to track overall, but also important when targeting specific audience segments or identifying opportunities.

Which of the following brands do you have a generally POSITIVE/NEGATIVE feeling about?

Consideration

Understand your target prospects by tracking Consideration. This brand health metric measures who is open to purchasing from your brand and its competitors.

When you are in the market next to make a purchase, which brands would you consider?

Purchase Intent

For everyone considering your brand, there will be blockers to purchase. Understanding your funnel is key. Who is actually prioritising you as their brand of choice? Purchase intent asks just that:

Of the brands considered, which one are you most likely to purchase?

Current Customer

Another good sign of brand health lies in your current customer base. The number of recent purchases - according to your sectors’ relevant sales cycle – offers a clear measure of success in the market against competitors.

Which brands have you recently purchased/currently own?

Former Customer

You don’t just want to track how many current customers you have – it's important to understand who a former customer is, and the opinions they might hold. Measuring former customers offers perspectives into brand health with lapsed purchasers, and how you might regain their custom.

Which brands have you ever purchased/ever owned? (Excluding Current Customers)

Customer Satisfaction (CSAT)

CSAT, or Customer Satisfaction, is a measure of your current customers’ happiness with your products or services. Satisfaction is a contributor towards recommendation, NPS and loyalty, fueling continued audience growth and laying the foundations for a successful brand.

Which of the following brands would you say that you are a SATISFIED / DISSATISFIED customer of?

Quality

Perceived product or service quality will dictate who your future customers may be, as a key influencer of purchasing behavior.

Which of the following brands do you think represents GOOD/POOR quality?

Value

Another key factor in building brand health is the value attributed to your products and services. Understanding price elasticity is essential, and so perceptions of your current price point will help inform future adjustments and market positioning.

Which of the following brands do you think represents GOOD/POOR VALUE FOR MONEY?

Corporate Reputation

Your brand might be having brilliant financial success, but what do people think about your brand as a potential employer? Would they be keen to work for you?

Corporate reputation metrics look at the perception of your brand within professional networks, highlighting areas for improvement and assessing your appeal as an employer.

Imagine you were looking for a job (or advising a friend looking for a job). Which of the following companies would you be PROUD/EMBARRASSED to work for?

Overall brand health (Index)

Your brand’s overall brand health or brand equity is usually measured across several of the above brand health metrics to give an informed summary of your brand’s position in the market.

At YouGov, we take an average across overall brand health including General Impression, Satisfaction, Quality, Corporate Reputation, Value and Recommendation.

Benchmarking this against competitors in your sector (or others!) allows you to identify areas where you excel and can improve to inform your future growth.

How to measure brand health: conducting a brand health survey

Brand reputation is shaped by consumer perceptions. To check you’re on the right track and identify areas for improvement, measuring brand health can be achieved in three main ways:

- Surveys / polls / questionnaires

- Always-on brand tracking or social listening tools

- Bespoke custom research

How does YouGov approach brand health tracking

Tracking your brand with YouGov is easy. Whether through a one-time survey to your audience, a custom brand health tracker, or connecting to our daily brand tracking tool - YouGov BrandIndex - for continuous brand health tracking. This flexibility ensures that you always have the right tools at your fingertips for measuring brand health effectively.

YouGov BrandIndex is our syndicated daily brand tracking tool, drawing on the thoughts and opinions of our panel of over 26 million registered panel members globally. With YouGov BrandIndex, we assess a wide range of brand health metrics daily, providing a complete picture of what people see, hear, and think about your brand along their consumer journey.

From gauging advertising awareness and consideration to understanding purchase intent, YouGov BrandIndex helps you navigate the complexities of brand health tracking. It’s more than just knowing your current customer base; it’s about gaining insights into ex-customers and those who favor your competitors.

YouGov’s brand health tracker also offers the ability to place your brand in a broader context. By comparing your brand to thousands of others across hundreds of categories, YouGov BrandIndex allows you to identify sector-specific trends and global market movements.

Tracking over 27,000+ brands every day across more than 55 major markets, YouGov BrandIndex provides a nuanced view of brand health across all sectors. Insights are delivered to through an easy-to-access and always-on dashboard, ensuring you’re constantly up to date on your brand’s health and market position.

Know what is happening to your brand, all the time.

If you enjoyed reading this, take a look below at some additional resources we thought you might like:

We aspire to be the leading European telecommunications provider. YouGov BrandIndex provides essential insights for making the right decisions for expanding the brand.